The Ultimate Guide to Forex Currency Trading Online 1822703860

The Ultimate Guide to Forex Currency Trading Online

Forex currency trading online has gained immense popularity in recent years. As the largest financial market in the world, with a daily trading volume surpassing $6 trillion, it offers abundant opportunities for traders. In this guide, we will explore the fundamentals of Forex trading, essential strategies, the significance of economic indicators, risk management techniques, and recommend some of the forex currency trading online Best Trading Apps for navigating this dynamic market.

What is Forex Trading?

Forex, or foreign exchange, refers to the process of buying and selling currencies in the global market. Unlike stock exchanges, the Forex market operates 24 hours a day, five days a week, accommodating traders from various time zones. The primary goal of Forex trading is to exchange one currency for another with the expectation that the price will change in favor of the trader.

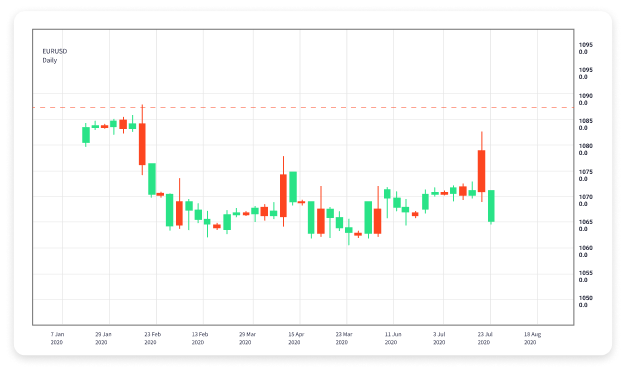

The Basics of Currency Pairs

In Forex trading, currencies are traded in pairs. Each currency pair consists of a base currency and a quote currency. The base currency is the first currency in the pair, while the quote currency is the second. For instance, in the currency pair EUR/USD, EUR is the base currency, and USD is the quote currency. Forex trading involves speculating whether the value of the base currency will strengthen or weaken against the quote currency.

Understanding Forex Market Participants

The Forex market comprises various participants, including:

- Central banks – They influence currency values through monetary policies.

- Commercial banks – They facilitate currency transactions for their clients.

- Corporations – Businesses engage in Forex trading for international transactions.

- Retail traders – Individual traders who speculate on currency price movements.

Key Factors Influencing Currency Prices

The Forex market is influenced by several factors, including:

- Economic indicators, such as GDP, employment rates, and inflation.

- Political stability and events, which can affect investor confidence.

- Market sentiment and speculation, driven by news and trends.

Trading Strategies for Success

Successful Forex trading requires a solid strategy. Here are some widely used trading strategies:

1. Scalping

Scalping involves making multiple trades throughout the day, seeking to profit from small price movements. This strategy requires quick decision-making and excellent market analysis skills.

2. Day Trading

Day trading involves opening and closing positions within the same day. Day traders can capitalize on short-term market trends by using technical analysis and real-time data.

3. Swing Trading

Swing trading is aimed at taking advantage of price fluctuations over a few days to weeks. Traders hold onto their positions until they identify the reversal of a trend or reach a predetermined profit target.

4. Position Trading

Position trading involves holding onto trades for longer periods, sometimes months or years, to benefit from major market shifts. This approach requires patience and a thorough understanding of fundamental analysis.

Risk Management Techniques

Effective risk management is crucial for long-term success in Forex trading. Here are some techniques traders can implement:

1. Setting Stop-Loss Orders

A stop-loss order automatically closes a position when the market reaches a specific price. This helps limit losses and protect capital.

2. Position Sizing

Determining the right position size for each trade is essential. Traders should only risk a small percentage of their total capital on a single trade to manage risk effectively.

3. Diversification

Diversifying across different currency pairs can help mitigate risk. By spreading investments, a trader can reduce the impact of adverse movements in any one market.

The Role of Economic Indicators

Economic indicators provide critical insights into a country’s economic health and can significantly influence currency values. Key economic indicators include:

1. Gross Domestic Product (GDP)

GDP measures a country’s economic output. A strong GDP growth rate can lead to a stronger currency, while a decline can weaken it.

2. Employment Data

Employment figures, such as Non-Farm Payroll (NFP) in the U.S., can impact currency prices. High employment rates usually support a stronger currency.

3. Inflation Rates

Inflation influences central banks’ interest rate decisions. Higher inflation can lead to rate hikes, boosting the currency’s strength.

Choosing the Right Trading Platform

Selecting a reliable trading platform is vital for successful Forex trading. When choosing a platform, consider the following:

1. User Interface

The platform should be user-friendly and easy to navigate, especially for beginners.

2. Trading Tools

Look for platforms that offer essential trading tools, such as charting software, technical indicators, and market analysis resources.

3. Regulation

Ensure that the platform is regulated by recognized financial authorities to guarantee the safety of funds.

The Future of Forex Trading

As technology evolves, so does Forex trading. The rise of artificial intelligence, algorithmic trading, and blockchain technology is transforming the way traders operate. Furthermore, mobile trading apps are making the Forex market accessible to a broader audience, allowing traders to participate from anywhere in the world.

Conclusion

Forex currency trading online offers exciting opportunities for profit but also comes with significant risks. By understanding the market’s fundamentals, developing effective trading strategies, implementing robust risk management practices, and leveraging technology, traders can position themselves for success in this dynamic world. Remember to always continue learning and adapting to new market conditions to thrive in Forex trading.